The PAN (Permanent Account Number) card is an important document for financial transactions and tax filings in India. Now, you can easily track status of your PAN Card and download your PAN card online, making the process quick and convenient.

The e-PAN is a valid, digitally signed version of your PAN card that can be used for all tax and financial transactions. This article will show you how to download e-PAN card step-by-step.

PAN Card Download

What is an e-PAN?

An e-PAN is an electronic copy of your PAN card, issued by the Income Tax Department. It is delivered in PDF format and can be used for all purposes that require a PAN card, including financial transactions, tax filings, and identity verification.

The e-PAN is equally valid as the physical PAN card.

Methods To Download e-PAN

There are three main ways to download your E-PAN (Permanent Account Number) card online: via NSDL, UTIITSL, and the e-Filing Portal.

| Visit the NSDL, UTIITSL, or Income Tax e-filing portal where you initially applied for your PAN card to download it. |

Via UTIITSL Portal

If you applied through UTIITSL, you can follow this process to download your e-PAN:

- Open your web browser and go to the official UTIITSL website - https://www.pan.utiitsl.com/.

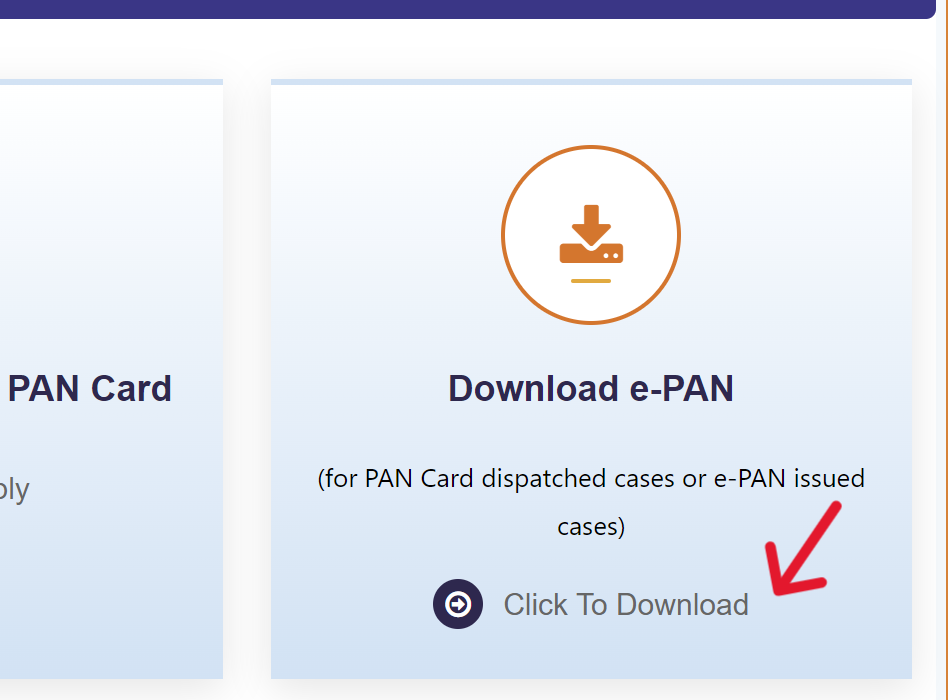

- Navigate to the section dedicated to PAN services and select the "Download e-PAN" option.

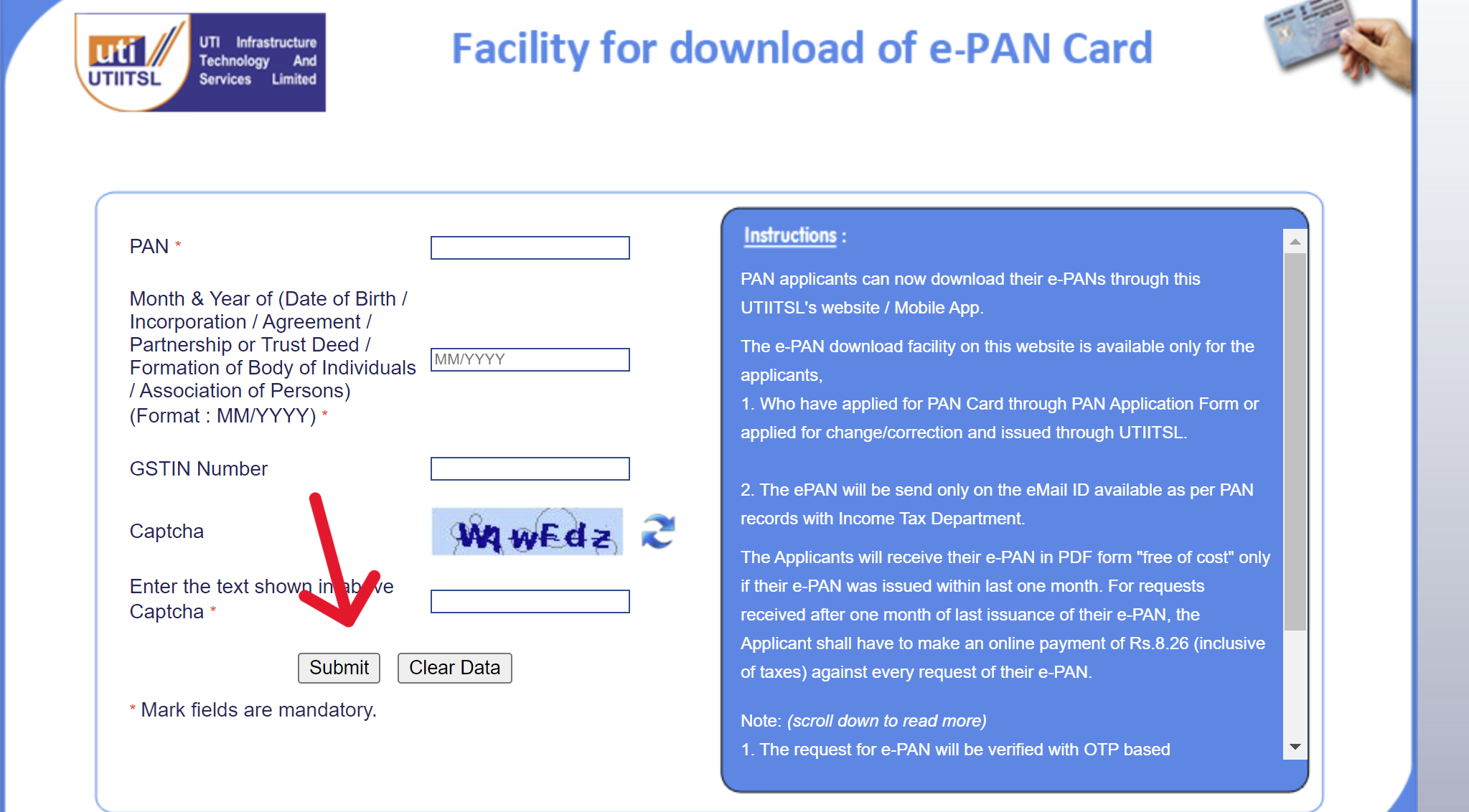

- Enter your PAN number, date of birth, and GSTIN (if applicable) in the required fields. Make sure all information is correct before proceeding.

- UTIITSL will send a download link to your registered mobile number or email address. Use this link to access your e-PAN card. Ensure that the mobile number registered with your PAN is active for OTP verification.

- Click on the download link and follow the on-screen instructions to download your e-PAN card.

| Note - You can download your e-PAN or Duplicate PAN Card PDF for free if you applied within the last 30 days; otherwise, it costs ₹8.26 per download. |

Download via NSDL

If you applied for your PAN card through NSDL (Protean), follow these steps to download your e-PAN:

- Begin by visiting the official protean NSDL e-Gov website - https://www.protean-tinpan.com/.

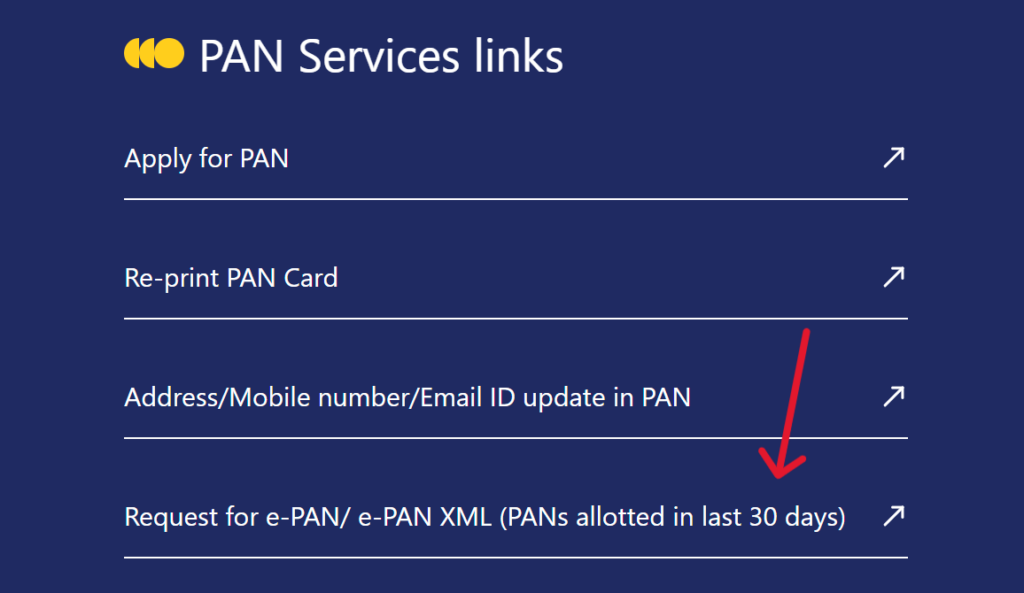

- On the homepage, navigate to the “PAN Services links” section.

- Choose either ‘Download e-PAN/e-PAN XML (PANs allotted in last 30 days)’ or ‘Download e-PAN/e-PAN XML (PANs allotted prior to 30 days)’ based on your application date. This will redirect you to a new page.

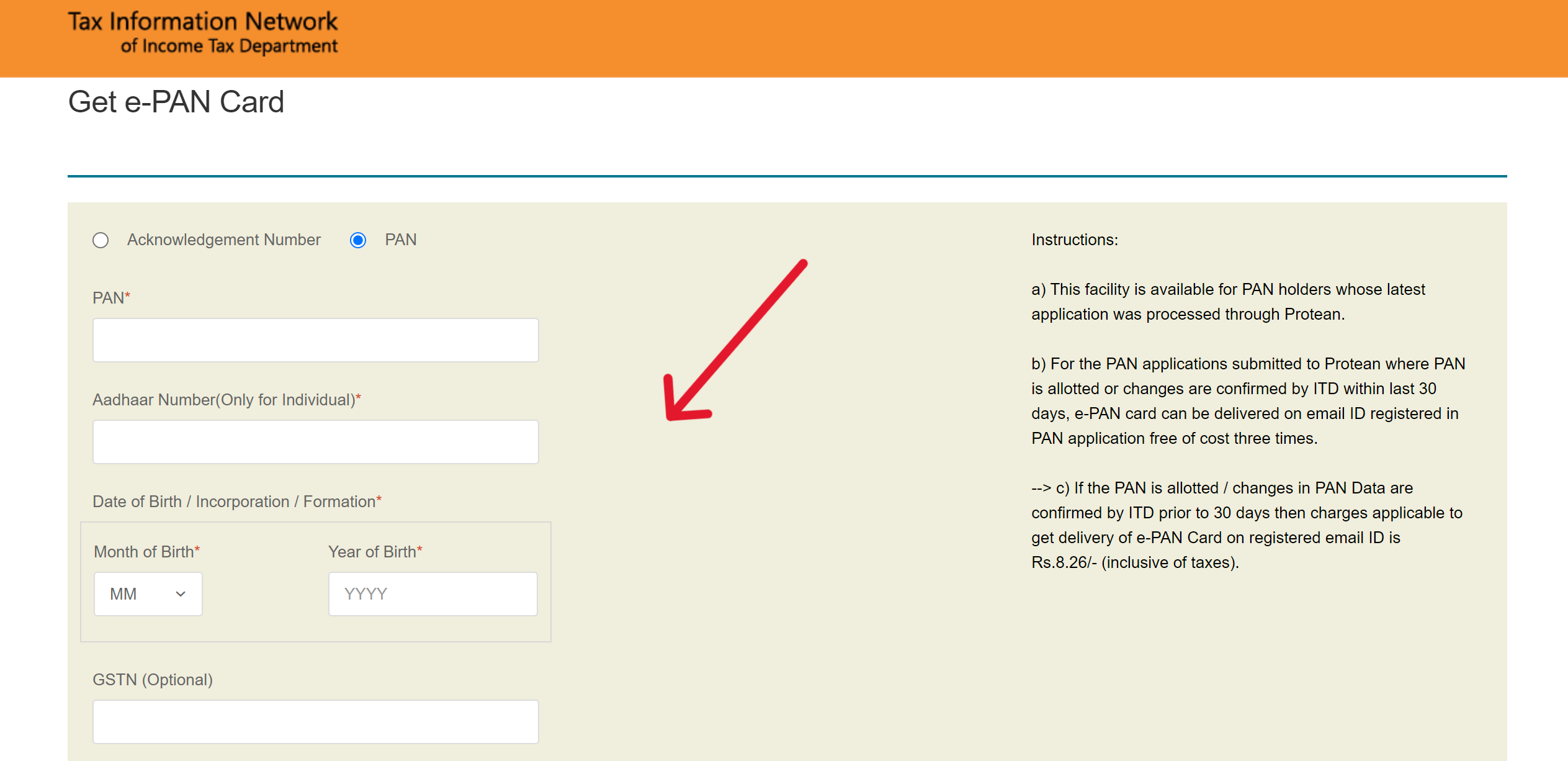

- On the new page, you can select either your PAN number or Acknowledgement number to proceed. Enter the required details, such as your PAN number, Aadhaar details, date of birth, and captcha code.

- Click the “Submit” button. You will then be able to download your e-PAN card in PDF format.

| If your PAN was issued or updated within the last 30 days, you can receive your e-PAN for free up to three times through the email address you provided in your PAN application. However, if your PAN was issued or updated more than 30 days ago, a fee of Rs. 8.26 (including taxes) will be charged to have the e-PAN delivered to your registered email address. |

Instant e-PAN Download

Instant e-PAN is a quick way to get your PAN card online using your Aadhaar number. Simply provide your Aadhaar, verify with an OTP sent to your registered mobile number, and download your e-PAN immediately.

To download your Instant e-PAN, follow these steps:

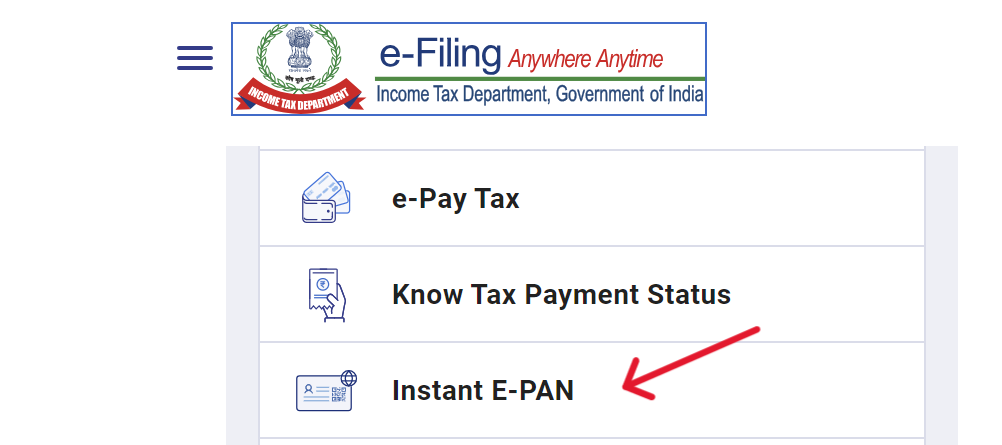

- Visit the official Income Tax e-filing website - https://www.incometax.gov.in/iec/foportal/.

- In the Quick Links section, click on "Instant e-PAN."

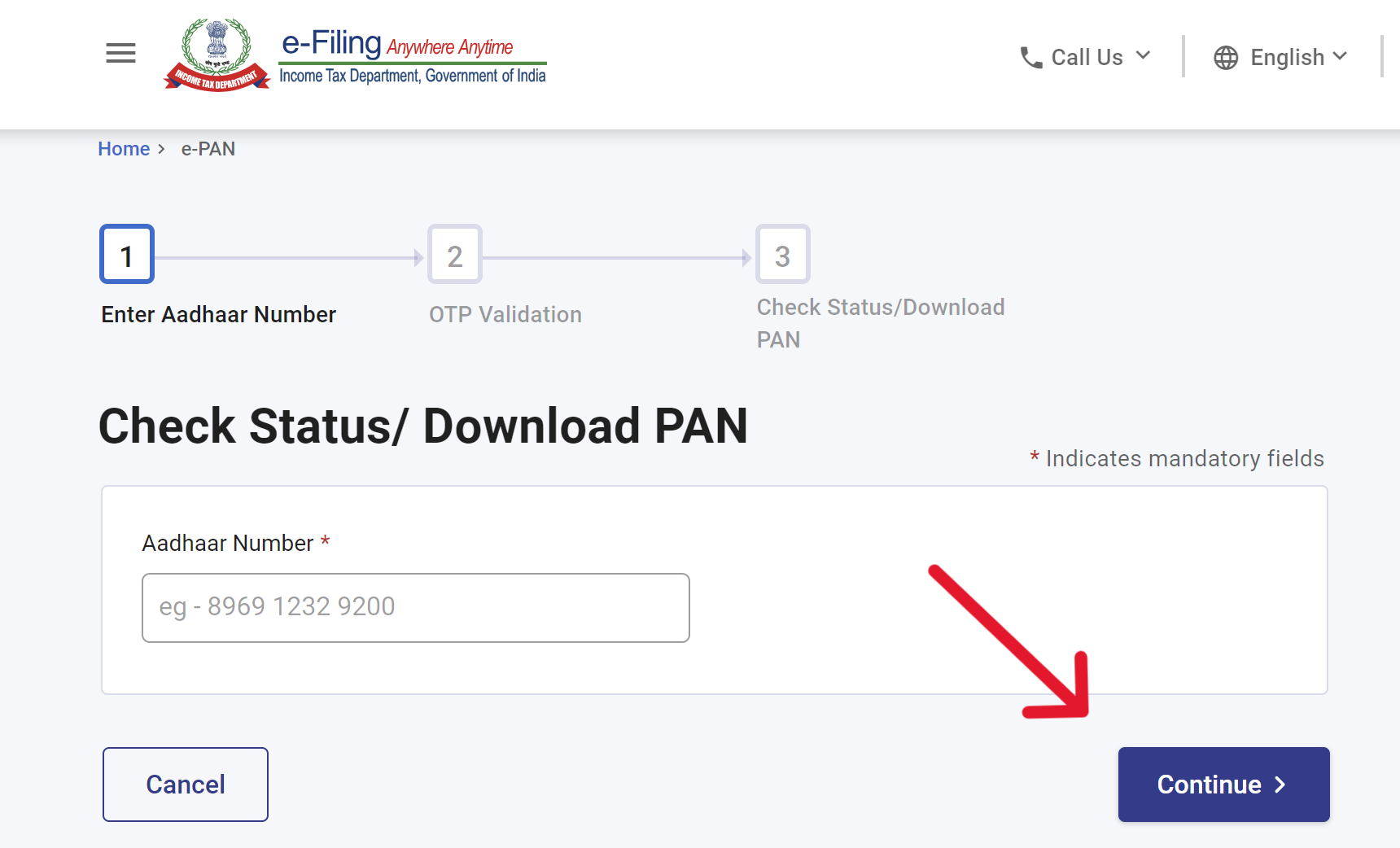

- Click on “Check Status/Download PAN” and then click “Continue.”

- Enter your Aadhaar number and click “Continue.”

- Enter the OTP sent to your registered mobile number and click “Continue.”

- If your e-PAN is ready, click the “Download e-PAN” button to get your e-PAN.

| Downloading an instant e-PAN on the e-filing portal is free of charge. You can download your PAN card instantly using your Aadhaar card on the e-filing portal. |

E-PAN PDF Password

The password to open your e-PAN PDF is a combination of your date of birth in the format DDMMYYYY. Here are a few examples to help you understand:

- If your date of birth is 15th August 1990, your e-PAN password will be 15081990.

- If your date of birth is 1st January 1985, your e-PAN password will be 01011985.

- If your date of birth is 25th December 1975, your e-PAN password will be 25121975.