A PAN (Permanent Account Number) card is an essential identification document for financial and tax-related activities in India. Verifying your PAN card ensures its authenticity, helps prevent fraud, and is crucial for legal and financial transactions.

This verification ensures that the PAN provided is genuine, preventing fraudulent use and simplifying tax-related transactions.

This article will guide you through the simple steps to verify your PAN card online using official portals.

Verification Process

You can verify your PAN card status using the Income Tax e-Filing portal or DigiLocker. Below, we have discussed both methods.

Via e-Filing Portal

Verifying your PAN card on Income Tax E-filing Portal - https://www.incometax.gov.in/iec/foportal/, is an easy online process. Here's how you can do it:

Prerequisites

- A valid PAN card

- Your mobile number

- For external agencies: An account on the e-Filing portal with a user ID and password

For Individuals:

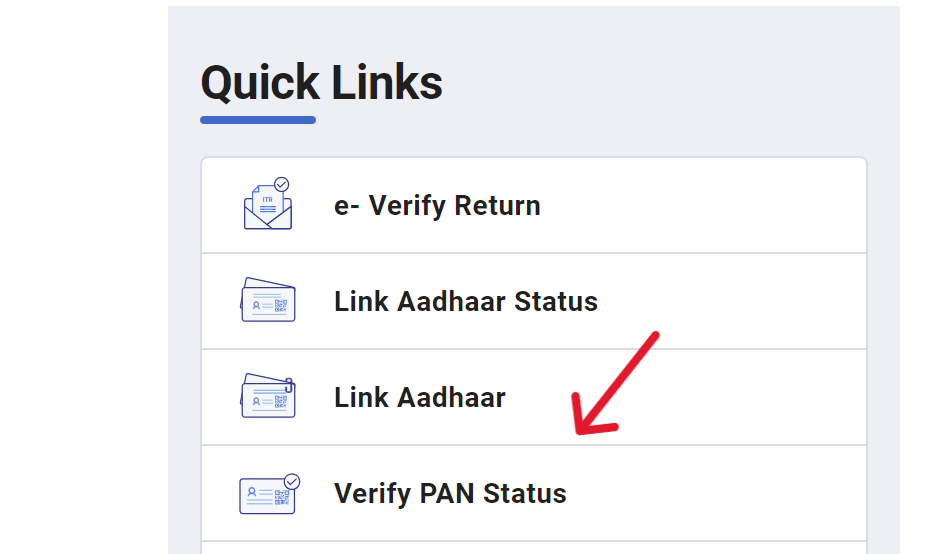

- Go to the e-Filing portal (https://www.incometax.gov.in/iec/foportal/) homepage.

- Click "Verify Your PAN" on the homepage.

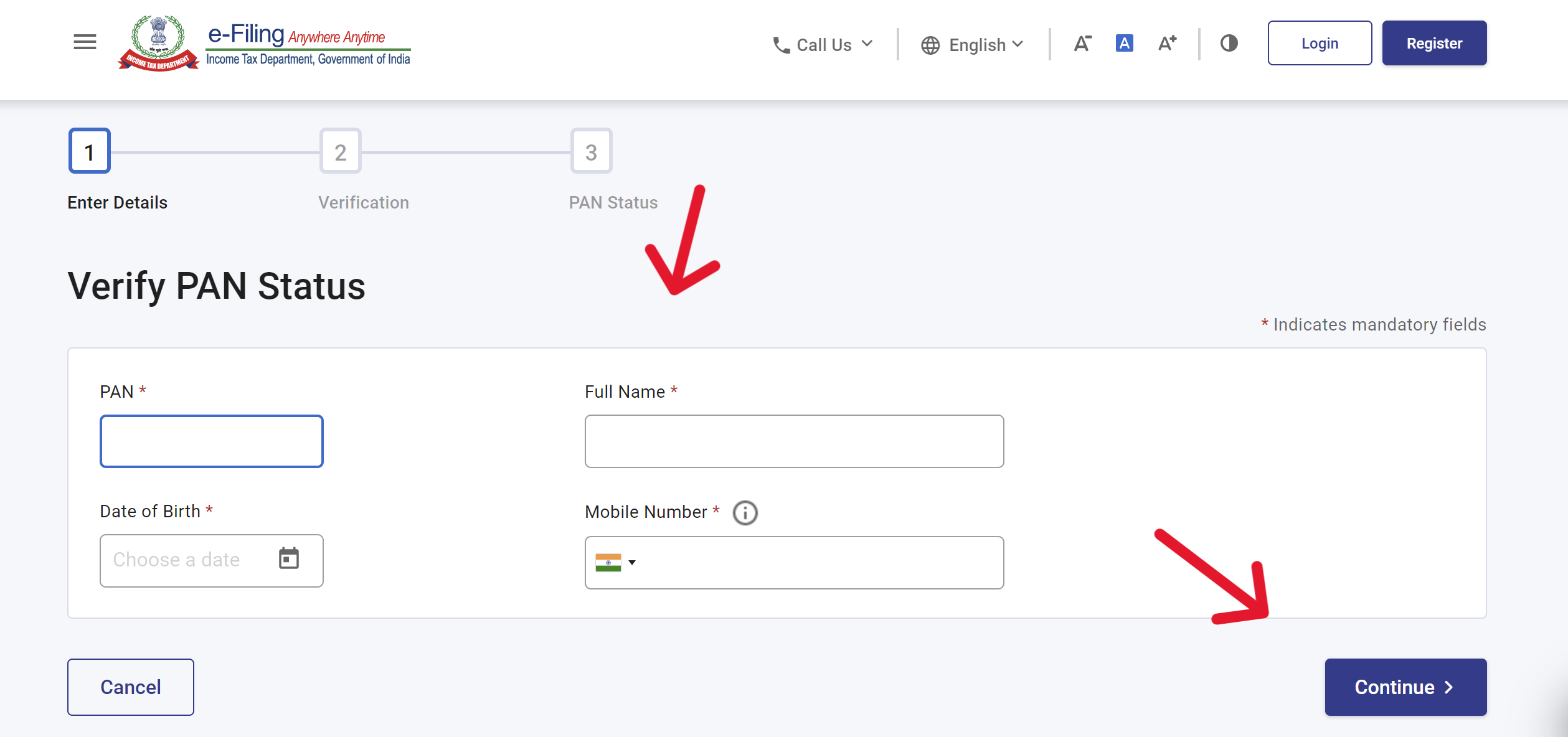

- Enter your PAN, Full Name, Date of Birth, and Mobile Number, then click "Continue."

- Enter the 6-digit OTP sent to your mobile and click "Validate."

Note:

- OTP is valid for 15 minutes.

- You have 3 attempts to enter the correct OTP.

- You can resend the OTP if needed.

After successful verification, your PAN status will be shown.

For External Agencies:

- Log in to the e-Filing portal using your user ID and password.

- Go to Services > View PAN details.

- Enter the PAN to be verified, Full Name, and Date of Incorporation (DOI) or Date of Birth (DOB), then click "Continue."

After successful validation, the PAN status will be displayed.

Via Digilocker

The Income Tax Department, Govt of India, offers PAN Verification Records to Indian citizens through DigiLocker. This service allows you to verify your PAN details in real-time, ensuring the accuracy of your information.

Follow these steps to verify your PAN through DigiLocker:

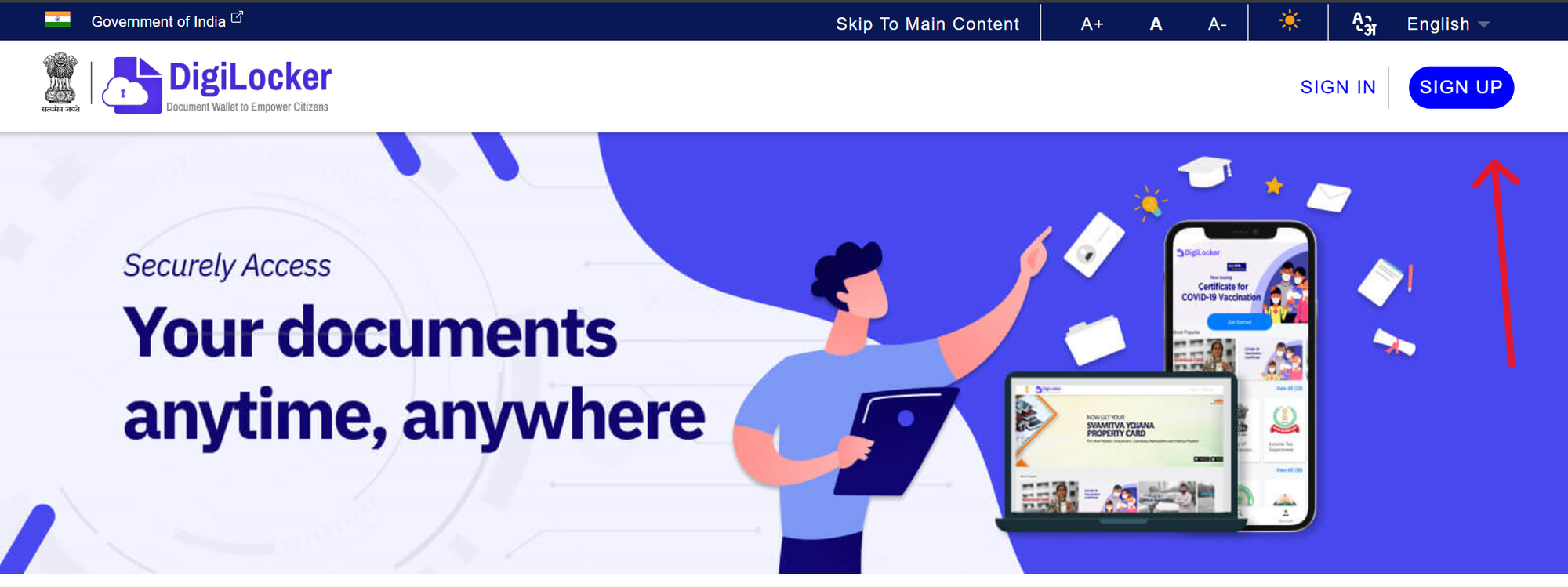

- Open the DigiLocker App or Website:

- Download the DigiLocker app from the App Store or Google Play Store, or visit the DigiLocker website.

- Sign In or Create an Account:

- If you already have a DigiLocker account, sign in using your credentials.

- If you are a new user, create an account by providing your mobile number and setting up a password.

- Link Your Aadhaar:

- Link your Aadhaar number with DigiLocker if not already done. This step is essential for accessing various documents, including PAN.

- Search for PAN Verification:

- In the search bar, type "PAN" and select the option for PAN verification.

- Enter Required Details:

- Provide your PAN number and any other required details.

- Fetch PAN Document:

- DigiLocker will fetch your PAN details from the Income Tax Department’s database.

- Verify PAN Details:

- Your PAN details, such as name, Date of Birth, and PAN status, will be displayed. Check if the details are correct and active.

By following these steps, you can easily verify your PAN card using DigiLocker. This method is convenient and ensures your details are securely retrieved from the official database.

| Note: You can also perform PAN Bulk Verification on the UTIITSL PAN portal by logging in. |

PAN Verification for Businesses and Bulk Users

For organizations that need to verify multiple PAN numbers (e.g., employers or financial institutions), the Income Tax Department offers a bulk PAN verification facility:

- Sign Up for Bulk PAN Verification: Organizations can register on the NSDL or UTIITSL portals to access bulk verification services.

- Upload PAN List: Once registered, businesses can upload a file containing the PANs to be verified.

- Get Verification Results: The system will return a list confirming whether each PAN is valid or invalid.

| In addition to the Income Tax Department’s portal, many private companies offer PAN verification services. These platforms usually charge a fee and allow for bulk verification, simplifying the process for large organizations. |

Why is PAN Verification Important?

PAN card verification is not only necessary for individuals but also for financial institutions, employers, and other organizations that rely on tax compliance. Here’s why it matters:

- Prevents Fraud: PAN verification ensures that the PAN card being used for any transaction is genuine, helping reduce fraudulent activities like identity theft.

- Legal Compliance: Businesses are required to verify the PAN details of employees, customers, and vendors to comply with tax regulations. For example, while filing TDS (Tax Deducted at Source) returns, it’s important to ensure the correct PAN is used.

- Error-Free Financial Transactions: Incorrect PAN details can lead to errors in financial transactions, affecting tax filings and returns. Verifying your PAN helps prevent such mistakes.